dekalb county alabama delinquent property taxes

Once your price quote is processed it will be emailed to you. You may request a price quote for state-held tax delinquent property by submitting an electronic application.

Henrico Va Tax Delinquent Sale Of Real Estate

The Delinquent Parcels listing is currently disabled.

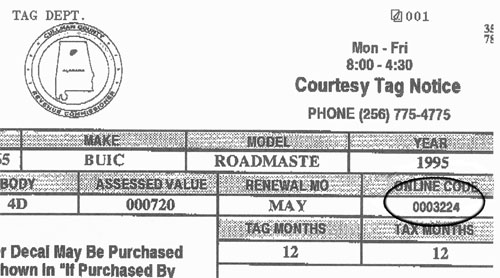

. Cash bank issued cashiers check or bank wire transfer. DeKalb County collects on average 032 of a propertys assessed. PROPERTY TAX Dekalb County Alabama.

Property Taxes are collected. Office of Independent Internal Audit. Once scheduled for a tax sale only the following forms of payment are accepted.

PROPERTY TAX Dekalb County Alabama. Property Tax OnlinePayment Forms Accepted. Each year the Revenue Commissioners Office auctions the real estate upon which taxes are delinquent at a public sale at the.

The median property tax in DeKalb County Alabama is 269 per year for a home worth the median value of 84400. In dekalb county alabama real estate property taxes are due on october 1 and are considered delinquent after december 31st of each year. DeKalb County Property Tax Records.

Debit Credit Fee 235. Thank you for participating in the. Please be aware that when you purchase at the tax sale you are purchasing taxes not property.

40-10-29 the purchaser of the Dekalb County Alabama tax lien certificate can apply for a tax deed to the. The second installment for DeKalb property taxes and City of AtlantaDeKalb payments are due Nov. Property Tax Online Payment Forms Accepted.

Under Alabama law a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it as hisher. Delinquent Tax Sale Information. All payments are to be made payable to DeKalb.

If the property is not redeemed within the 3 three year redemption period Sec. Delinquent Tax Sale Information. Contact Us 256 845-8515.

Tax Delinquent Properties for Sale Search. View Alabama tax delinquent properties available for purchase sorted by county including search by name or parcel number. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property.

256 845-8517 DeKalb County Revenue. Payments can be made online by mail kiosk or phone. Debit Credit Fee 235 E-Check Fee FREE.

Alabama Property Tax Calculator Smartasset

Dekalb County Revenue Commissioner Fort Payne Al Facebook

Taxes Dekalb County Revenue Commission

Tyler Wilks Archives Southern Torch

Georgia Woman Sentenced For Bribing Former Supervisor In The Dekalb County Tax Commissioner S Office Coosa Valley News

Tax Lien Sale Tuscaloosa County Alabama

Tax Sale Listing Dekalb Tax Commissioner

Legal Notices For The Week Of April 7 14 2017 And Delinquent Tax Notifications Gadsden Messenger

Dekalb County Revenue Commission

Alabama Has Some Of The Lowest Property Taxes In The Us Southeastern Land Group

Property Information Dekalb Tax Commissioner

Payyourpropertytax Com Dekalb County Property Tax

A Tax Deed Is Not The Same As A Title Alabama Real Estate Lawyers

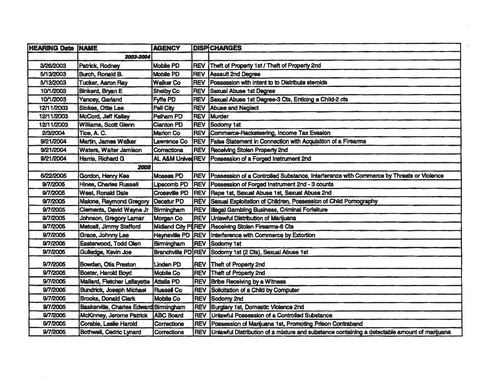

Alabama Police Officer Decertification Prison Legal News

Here S How Your Property Taxes In Dekalb County Could Change This Year

Office Of The Revenue Commissioner Jackson County Al

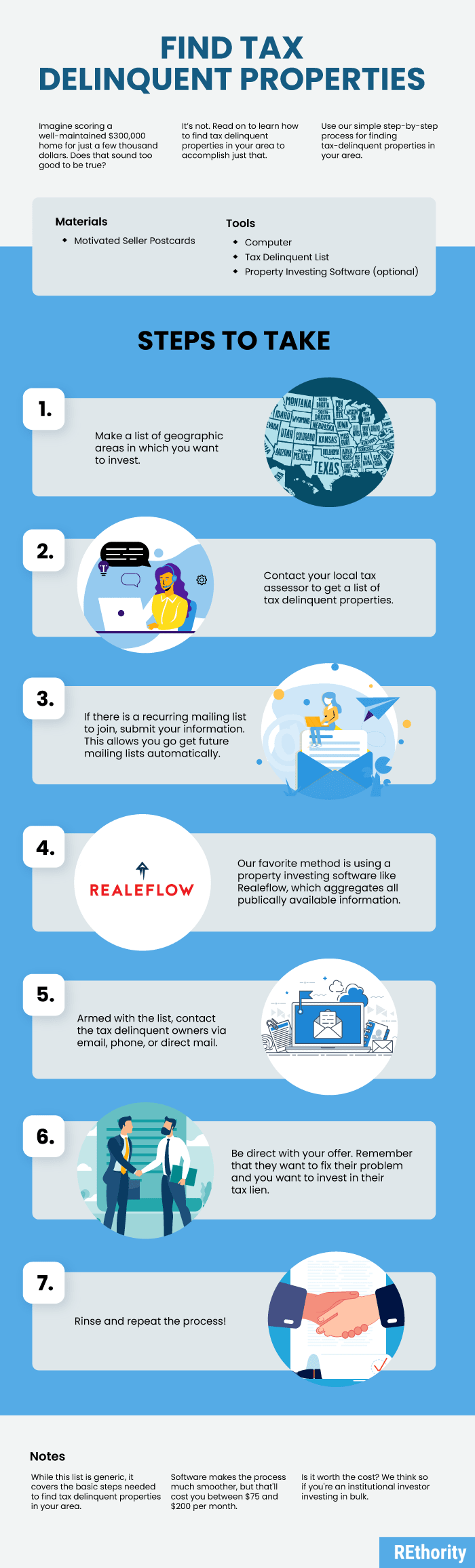

How To Find Tax Delinquent Properties In Your Area Rethority